FinTech & Banking

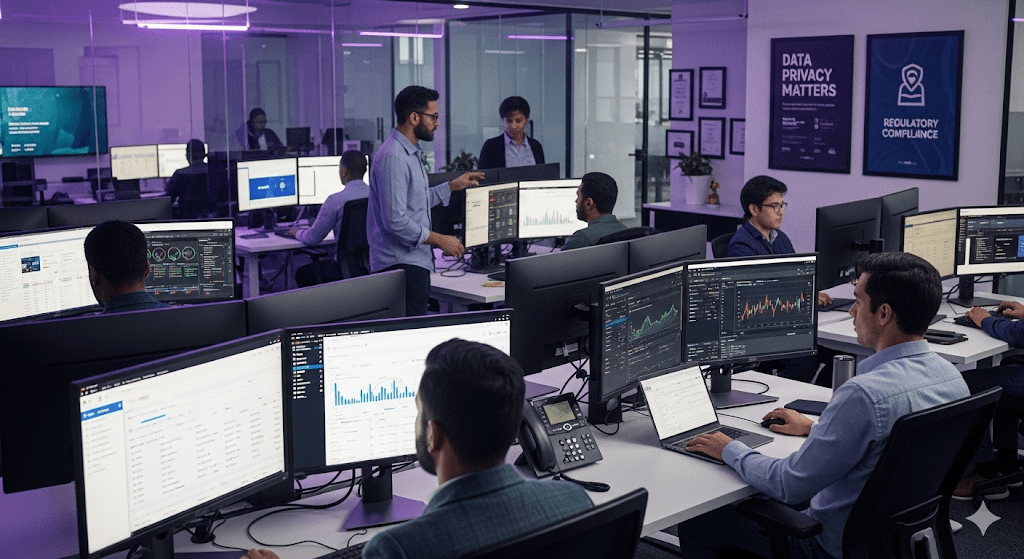

Transform financial services with innovative technology solutions that meet the highest standards of security and compliance. From digital banking to blockchain applications, we build fintech products that revolutionize how people manage, move, and invest money in the digital age.

Build Your FinTech Solution

FinTech Excellence Through Security & Innovation

With 20+ fintech projects delivered processing over $100M in transactions, we understand the unique challenges of financial technology. Our solutions combine cutting-edge innovation with bank-grade security and regulatory compliance.

Bank-Grade Security

Security is non-negotiable in finance. We implement encryption, multi-factor authentication, fraud detection, and compliance frameworks (PCI DSS, PSD2) to protect sensitive financial data and transactions.

Regulatory Compliance

Navigate complex financial regulations with confidence. Our solutions meet KYC/AML requirements, GDPR compliance, and regional banking regulations while maintaining excellent user experience.

Our FinTech Development Approach

Compliance & Security Assessment

Analyzing regulatory requirements, security needs, and compliance frameworks to ensure your solution meets all financial standards.

Architecture Design

Creating secure, scalable architecture with encryption, authentication, and audit trails built into the foundation.

Secure Development

Building financial applications using secure coding practices, regular security audits, and penetration testing.

Integration & Testing

Integrating with banking APIs, payment gateways, and third-party services while conducting thorough security and compliance testing.

Deployment & Monitoring

Secure deployment with continuous monitoring, fraud detection, and compliance reporting to maintain security and trust.

Our Technologies

What Our Clients Say About Our Cooperation

FAQ

Couldn't find what you were looking for? write to us at help@myplanet.design

How do you ensure financial data security?

We implement multiple security layers including end-to-end encryption, tokenization, secure key management, regular security audits, penetration testing, and compliance with PCI DSS and banking standards. Security is built into every aspect of development.

What about regulatory compliance?

We stay current with financial regulations including KYC/AML requirements, PSD2 in Europe, open banking standards, and regional compliance. We work with legal experts to ensure your solution meets all regulatory requirements.

Can you integrate with existing banking systems?

Yes, we integrate with core banking systems, payment processors, and financial APIs. We use secure API connections, handle data synchronization, and ensure seamless integration while maintaining security and compliance.

What fintech solutions do you build?

We develop digital banking platforms, payment processing systems, peer-to-peer payment apps, cryptocurrency exchanges, robo-advisors, lending platforms, and insurance technology solutions.

How long does fintech development take?

Timeline depends on complexity and compliance requirements. Simple payment apps: 3-4 months. Digital banking platforms: 6-9 months. Complex trading platforms: 9-12 months. We use phased approaches to deliver value incrementally.

What's the cost of fintech development?

Fintech projects range from $50,000 for simple payment solutions to $500,000+ for comprehensive banking platforms. Investment includes development, security audits, compliance certification, and ongoing maintenance.

Get In Touch

Get In Touch